[This is a post by ASEM Fellow Donald Kennedy]

I have heard a recurring theme at ASEM conferences where academics talk about how to calculate earned value and the practitioners say they have never actually seen earned value calculated in the field. This is an article about a simple way to do earned value analysis that actually works! I have used this method in controlling a billion dollar project (and smaller ones), so it should work for you, too.

One question that Project Managers should try to answer is “are we above or below budget”. That is the question I am going to show how to answer here. The variables I mention in the title are those you find when you do a literature search on earned value, such as BCWP and ACWP. Every so often, I re-learn the meanings of these variables, but I find I quickly forget them through lack of actually ever using them. Earned value analysis determines which of the four permutations of over or under and schedule or budget reflects the status of your project (e.g. ahead of schedule and over budget). To figure out if you are ahead or behind schedule, you simply update the plan with the most current information and see what your new completion date is (that is all I will say about that topic here). For budget, you can simply do a similar exercise. The forecasted completion date is just the original plan updated to reflect the most current information. The forecasted cost at completion should also just be the original cost estimate updated with the new information. I have seen other project teams struggle with forecasts -- making it a focused task, perhaps done quarterly, going through an entire re-estimation of the entire project. This is not only time consuming, it results in getting information sporadically and too late to make any corrective changes.

Going into a project, you should organize your work breakdown structure (WBS) so that every piece of information you receive about cost (bids, quotes, invoices, or a payments, etc.) will be represented by an item in your budget / forecast. Accountants tend to group costs by asset type for depreciation and other long-term company purposes, so you probably cannot just rely on the standard coding practice. On the billion dollar project mentioned above, there ended up being over 30,000 transactions, so many people stated my method would be too difficult to use. However, in keeping with the Pareto principle, 4000 of these items represented 95% of the costs. Having a “Miscellaneous” line in my budget representing $50 million sounds rough to the inexperienced, but it proved quite manageable. Tracking 4000 items by sifting through the 30,000 transactions required a couple of hours a day, or about 10 hours a week. I will also note that due to the company’s ERP system set-up, the accounting data came in the form of a several inch thick hard copy printout. Items such as quotes and bids were sourced through phone calls to the responsible people. The point is this system is manageable if set up well to start.

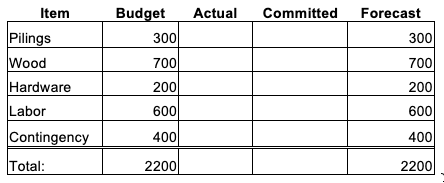

So I will proceed with a demonstration using a simple children’s play area as an example. From the experience of others you hear that the type of play area you want to build will cost about $2200. Your estimating department provides the following estimate based on the scope you provided:

Now a common error that is well documented is that details provide a confidence that may not be well-founded. The problem comes from listing all the knowns, and there will be unknowns. The difference between the sum of knowns and the typical cost from experience can be called ‘contingency.’ This should then establish the budget. The tool you can use to manage your project will look like this:

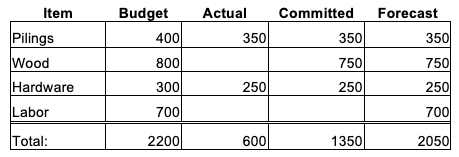

In order to properly manage a project, you need to know the most accurate information. If you simply add a buffer to each item “just in case” or to avoid blame for being wrong, this distortion impedes understanding. Showing the uncertainty as contingency helps you remember it is there for that reason. Changing numbers to fool others (such as your management) comes with the risk of ending up fooling yourself. Let’s say you inflate each line to allow for some contingency on each item. Halfway through the project, your spreadsheet may look like this:

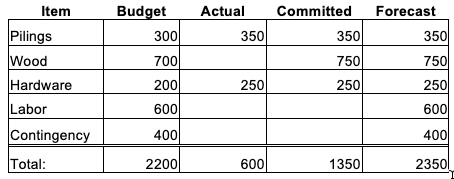

So far, every item has come in under budget. Things appear to be trending well and you are starting to feel comfortable. You may forget that you padded each line with a buffer, and the real costs are actually all coming in higher than you expected. Using my suggested format with an allowance for unknowns, the snapshot for the same real costs now becomes:

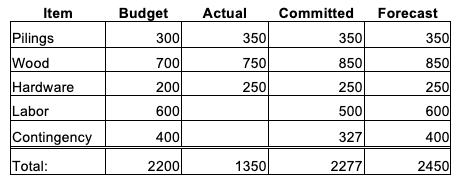

The false comfort from before now becomes concern as everything is clearly trending higher than you expected. Let’s say a new development is that you realize the wood you purchased was for the quantity required, forgetting that 20 feet of board in two 10ft pieces cannot be cut to make three 6ft lengths, even though the total required is 18ft (2ft less than the amount ordered). The order for the additional wood is $100. As well, you learn that you need to light the area and have the design stamped by a professional engineer under your jurisdiction’s local regulations. These unplanned items cost $327 total. You also get a rough estimate from a contractor engaged to provide the labor for $500. Based on past experience with this contractor, your best guess is that the final cost for the work will be 20% more than the rough guess. The snapshot of your cost performance now looks like this:

Every time you get new information, you enter it into the spreadsheet and you get a new forecast. At the point shown above, you now see that you have spent 1350/2200 = 61% of the budget, you have committed 4% more than the budget and you are forecasting an 11% overrun. What you actually report at any time within your organization or to other stakeholders is up to your discretion as the project manager, but at least you know yourself where you sit.

So just to lay out my rules explicitly:

1) The budget should be expressed as a detailed estimate. If this is not the first project of this type you are doing, the spreadsheets from the previous jobs can become the basis for this detailed estimate. Changes in quantity can be accommodated.

2) The budget for each item should be what you expect the costs to be. Padding the numbers misleads you on your original expectations.

3) The coding for the costs as they come in should parallel as much as feasible the structure of the estimate.

4) The difference between the approved budget and the total of the detailed estimate is your allowance for unknowns, or contingency. If the budget is lower, then you are in the situation often joked about by project managers: “I haven’t even started yet and I am already over budget!”

5) A common request I have heard from the team is that the contingency must be higher to cover inflation. If you know the costs are going to be higher than last time, then the budget for those items should be increased. If you are pretty sure an unknown is going to happen, then it is not an unknown by definition.

6) The forecast is the budget updated with the latest information.

7) The forecast for an item starts as its budget.

8) When new information comes in, the forecast for that item should reflect this new information. If a line item is tendered as a contract, the forecast can be changed at the time the bids are opened. The bid you expect to be the winner can be used as a basis for the new forecast amount (perhaps with some additional for expected cost extras on the contracted price).

Using this method provides the answer to where you sit on the cost performance of the project. Even if it does not look like Earned Value, that is what it really is. The forecast starts out as the budgeted amount and then it is replaced with the actual amount. The amount of work “earned” is the budget amount that is replaced by the actual cost.